When analyzing the worth of a company or asset, investors often encounter two essential concepts: face value and book value. Face value represents the declared amount on a security, while book value is calculated based on a company's accounting records.

In essence, face value is the visible value, often found on a bond or stock certificate. However, book value reflects the historical investment of a company's assets minus its liabilities.

- Grasping the separation between these two concepts is essential for making informed investment decisions.

- Face value can be deceptive as it does not always reflect the true meaning of an asset.

- Alternatively, book value may not accurately capture the current market state.

Recognizing the True Worth: Face Value vs. Book Value

When assessing an asset, it's crucial to distinguish between its face value and book value. Face value represents the actual price at which something is traded. , However, book value reflects its recorded worth on a company's accounting statements. This variation often stems from factors like impairment, market fluctuations, and the consideration of intangible properties.

Understanding these concepts is essential for investors to make prudent judgments. A high face value doesn't always imply a high true worth, and . Conversely.

Beyond the Surface: Unveiling Asset Values Through Face and Book

In today's complex market landscape, determining asset values goes extending past mere superficial glances. Advanced tools like face and book analysis offer a powerful lens to penetrate the surface and uncover genuine asset worth. These methodologies leverage statistical power to uncover valuable information from vast pools of financial records. By deciphering patterns and trends, investors can gain a comprehensive understanding of an asset's potential.

- Leveraging face analysis allows us to evaluate historical market performance, revealing significant clues about future movements.

- Alternatively, book analysis delves into financial records, providing a in-depth picture of an asset's stability.

Synergizing these powerful tools enables investors to make data-driven decisions, minimizing risk and maximizing potential profits.

Market Value vs. Accounting Value: An Examination

When analyzing the financial health of a company, investors often consider two key metrics: face value and book value. Face value, also known as market value, indicates the current valuation that a security is trading for the marketplace. On the other hand, book value, or accounting value, reflects the documented worth of a company's assets subtracting its liabilities based on its financial statements. While both provide valuable insights into a company's standing, understanding their differences is crucial for making informed investment decisions.

- In essence, face value reflects the market's perception of a company's future prospects, while book value provides a snapshot of its past financial performance.

- Examining both metrics in conjunction can provide a more comprehensive understanding of a company's true estimate.

Measuring Financial Health: The Significance of Face and Book Value Relevance

Determining the financial health of a company requires careful analysis of several key metrics. Among these, face value and book value stand out. Face value represents the stated worth of an asset, often found on its surface. Conversely, book value reflects the documented cost of an asset according to a company's ledger entries.

Understanding both face and book value is vital for investors as it offers a more complete picture of a company's possessions. While face value may beexaggerated, book value expose potential reduction in an asset's value over time.

By comparing these two metrics, investors can achieve valuable insights into a company's actual financial position and make more well-reasoned investment decisions.

Investing Insights: Navigating the Difference Between Face and Book Value

When delving into the realm of investments, comprehending the distinction between face value and book value is paramount to making informed decisions. Stated value represents the nominal worth specified to a security, typically reflecting its initial price. Conversely, book value embodies the recorded worth of a company's assets subtracting its liabilities. click here This intrinsic value provides a snapshot of a firm's market health as per its statements.

While both metrics offer valuable insights, they serve distinct purposes. Face value is primarily relevant for debt securities like bonds, while book value provides a deeper understanding of a company's standing over time. Investors often leverage both metrics in conjunction with other fundamental indicators to formulate comprehensive investment plans.

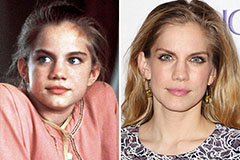

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!